The form you use to figure each credit is shown below.

Irs rules for solar tax credits.

The residential energy credits are.

A list of forms for claiming business tax credits and a complete explanation about when carryovers credits and deductions cease.

The credit is available through the end of 2019.

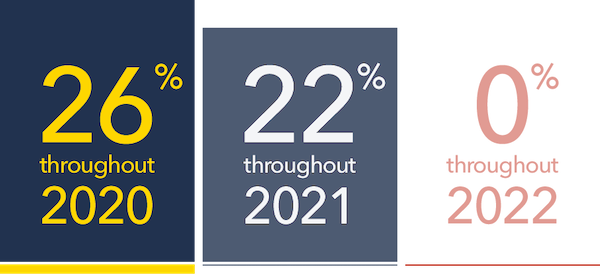

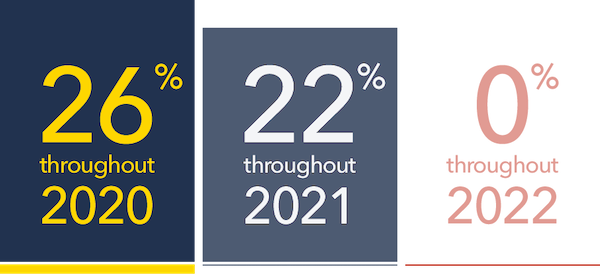

A brief overview when you install a solar system 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

After that the percentage steps down each year and then stops at the end of 2021.

New york offers a state tax credit of up to 5 000.

Residential commercial and utility scale solar projects may qualify for the full 30 percent investment tax credit itc as long as construction begins in 2019 and the project is placed into.

Use form 5695 to figure and take your residential energy credits.

It will decrease to 26 for systems installed in 2020 and to 22 for systems installed in 2021.

Arizona and massachusetts for instance currently give state income tax credits worth up to 1 000 toward solar installations.

What improvements qualify for the residential energy property credit for homeowners.

Solar energy technologies and the tax credit expires starting in 2022 unless congress renews it.

These instructions like the 2018 form 5695 rev.

All of the following credits with the exception of the electric vehicle credit are part of the general business credit.

About form 4255 recapture of investment credit about form 8453 u s.

Irs guidance issued with respect to the energy credit under section 48 in publication items such as notice 2018 59 has no applicability to the residential energy efficient property credit under section 25d.

Use these revised instructions with the 2018 form 5695 rev.

A solar pv system must be installed before december 31 2019 to claim a 30 credit.

If you spend 10 000 on your system you owe 2 600 less in taxes the following year.

Federal solar tax credit.

Credits for approved solar installations installing alternative energy equipment in your home can qualify you for a credit equal to 30 of your total cost.

The solar tax credit expires in 2022.